per capita tax in pa

Get Results On Find Info. Who owes per capita tax.

Web Per capita exemption requests can be submitted online.

. Per Capita means by head so this tax is commonly called a head tax. Current Per Capita Taxes. Earned Income Tax Regulations.

The municipal tax is 500 and the school tax is 1000 These taxes are due on an annual basis. Each resident or inhabitant over eighteen years of age in every school district of the second third and fourth class which shall levy such tax shall annually pay for the use of the school district in which he or she is a resident or inhabitant a per capita tax. Reminder to pay your Per Capita tax bill before December 31st.

With an estimated population of 95112 as of the 2020 census it is the fourth most populated city in the state after Philadelphia Pittsburgh and Allentown. Individual Taxpayer Mailing Addresses. Acceptable forms of payment include cash check or money order.

Web What is per capita tax. Web Act 511 Taxes for Pennsylvania School Districts Glossary of Terms. Web Personal Income Tax.

Web City of Reading. I am new to the area can I get added the tax rolls. Payments may be mailed to.

FAQ for Individual Taxpayers. Web PER CAPITA TAX INFORMATION. Are payment plans available.

Exoneration from tax is applicable to the current tax year only. Municipalities and school districts were given the right to collect a 1000 per capita tax under ACT 511 and School Districts an additional 500 under ACT 679 School Tax Code. The application form may be used by a PA taxpayer whose community has adopted one or more tax exemptions.

It is not dependent upon employment. Web The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. Web The Per Capita Tax imposed by the North Allegheny School District is also collected by the Town of McCandless.

Business Gross Receipts Tax. Discount Amount Taxes must be paid by September 30 for 2 discount. For most areas adult is defined as 18 years of age and older.

Reminder to pay your Per Capita tax. Search Pa Per Capita Tax. The City of Corry Per Capita tax is 1500.

Per Capita taxes are assessed by the Municipality and the Franklin Regional School District on all residents who have attained the age of twenty-one 21. Links for Individual Taxpayers. Web This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership.

Web The Per Capita Tax bill is sent in July. Why do I have to pay a per capita tax. Per Capita Tax is a tax levied by a taxing authority to everyone over 17 years of age residing in their jurisdiction.

Web Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. Web Per Capita Tax. Web 1 day agoA new report from the state Independent Fiscal Office shows 157 billion of school property tax collections statewide in fiscal 2021 with Monroes share amounting to 2089 per capita.

The rate is 10 per person per fiscal year July through June. Wilson school district 2601 grandview blvd west lawn pa 19609. How do I remove the taxpayer from the tax rolls.

Section 6-679 - Per capita taxes. Web ACT 679 Tax is a 500 Per Capita Tax authorized under the PA School Code and is addition to the 1000 Per Capita that can be levied and shared by your school district with your municipality. Kenhorst Borough - 500.

If your income changes you move out of Antis Township or you have any questions about the Per Capita Tax please call Susan E. Web the wilson school district tax office normal business hours of monday friday 730 am 400 pm. Who owes per capita tax.

How do I file a request for exemption from the per capitaoccupation tax. Per Capita means by head so this tax is commonly called a head tax. The tax will be included.

Occupational Assessment Taxes are assessed on all. Act 511 Taxes Flat Act 511 Taxes Proportional Amusement Tax. Act 511 of 1965.

I received a per capita tax bill however the named taxpayer is deceased. Beginning in 2020 these two taxes will be included on one bill which will. Sales Use and Hotel Occupancy Tax.

Per Capita taxes not paid by December 31 will be submitted to Berkheimer Associates. Access Keystones e-Pay to get started. You must file exemption application each year you receive a tax bill.

This tax applies to all residents of the Town of McCandless age 21 and over employed or not employed who reside in the District for any part of the fiscal year. I am a Phoenixville resident. Web Tax Fee.

Normally the Per Capita tax is NOT withheld by your employer. Motor and Alternative Fuel Taxes. Ad Search Pa Per Capita Tax.

All july 2022 per capita and real estate tax bills are due by december 31 2022. This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership. 8391 Spring Rd Ste 3 New Bloomfield PA 17068.

For most areas adult is defined as 18 years of age and older though in some areas the minimum age may differ. Web A Per Capita tax is a flat rate tax equally levied on all adult residents within a taxing district. Governor Mifflin School District - 1000.

Web The City of Reading located in southeastern Pennsylvania is the principal city of the Greater Reading Area and the county seat for Berks County. Web Occupation Assessment Tax. Per capita taxes are levied to all adults residing in a taxing authority.

Earned Income Tax Information for Employers.

The Salary You Need To Afford The Average Home In Your U S State Vivid Maps

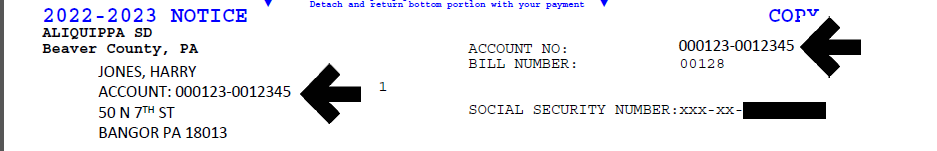

Real Estate And Per Capita Tax Wilson School District Berks County Pa

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Property Tax Definition Property Taxes Explained Taxedu

Per Capita Tax Exemption Form Keystone Collections Group

Which States Pay The Most Federal Taxes Moneyrates

Information About Per Capita Taxes York Adams Tax Bureau

Per Capita Tax Exemption Form Keystone Collections Group

City Of Monongahela Tax Information

Randee A Scritchfield Wrightsville Borough Tax Collector Facebook